What You Should Know About Getting a Mortgage Right Now

If you’ve been putting off buying a home because you thought getting approved would be too tough, here’s some encouraging news: qualifying for a mortgage is starting to get a little easier for well-qualified buyers. Lending standards remain solid, but banks are opening more doors to help boost homeownership.

That’s good news for folks here in Savannah and across Georgia who’ve been watching rates and wondering if this is the time to jump in.

Lenders Are Making It a Bit Easier to Get Approved

Lenders are starting to loosen up just a little. They’re approving more buyers who may have slightly lower credit scores or smaller down payments. If tight requirements kept you on the sidelines before, this could be the opportunity you’ve been waiting for.

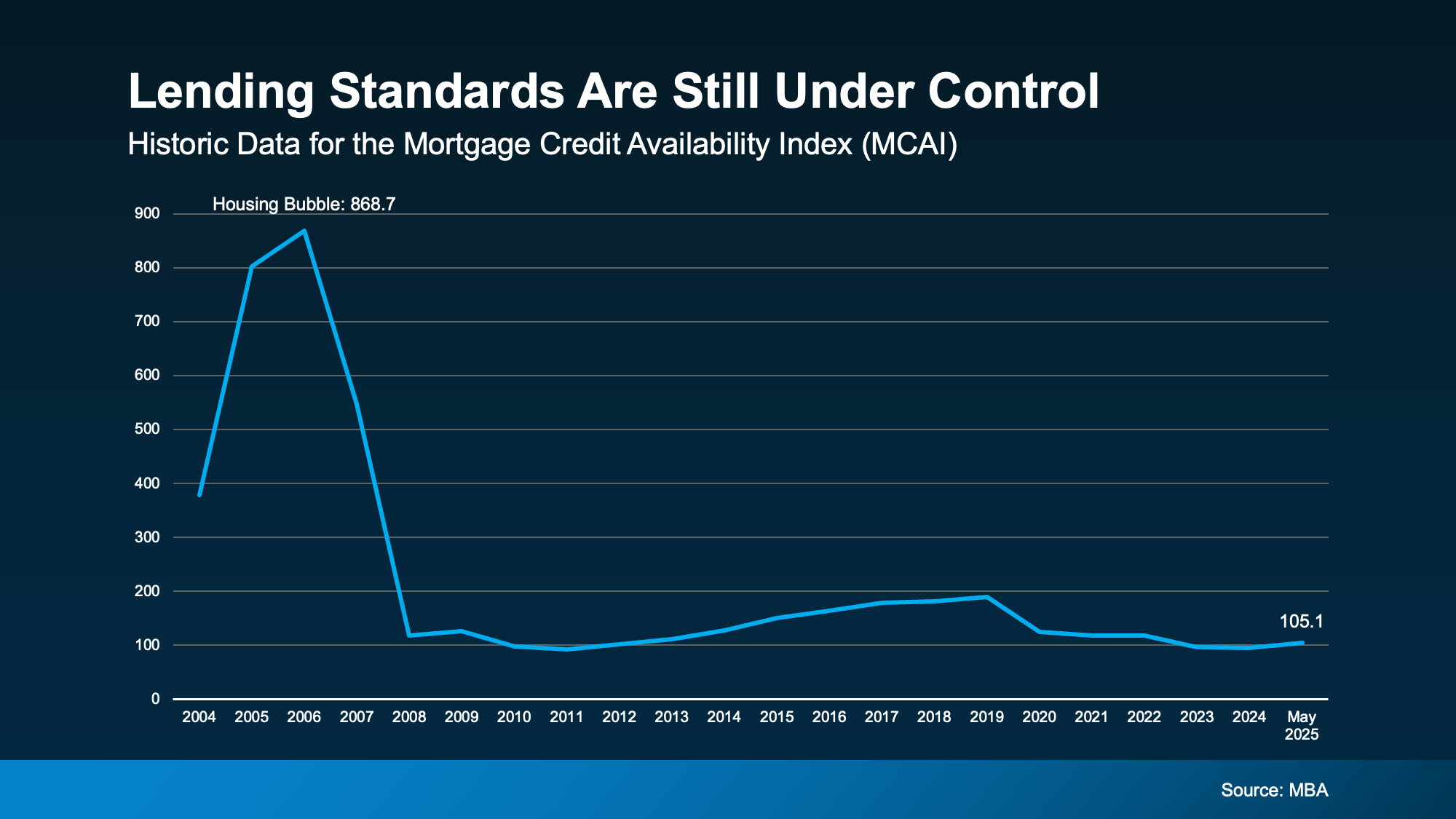

But here’s what’s important: this isn’t a repeat of 2008. Lending standards today are still much stronger than they were before the housing crash. Responsible lending is still the rule.

Industry data backs this up. The Mortgage Bankers Association’s Mortgage Credit Availability Index (MCAI) - which measures how easy or hard it is to get a mortgage - has been rising lately. In May, it reached its highest point in nearly three years.

That means banks are feeling a little more confident about helping qualified buyers get into homes.

“Is This Like the Housing Bubble?” Nope.

It’s a smart question to ask. After all, loose lending practices helped fuel the housing crisis back in 2008. But today’s market is different.

Yes, lenders are making mortgages more accessible but they’re still sticking to responsible underwriting. Compared to the lead-up to the housing crash, credit standards today are much more stable and controlled.

As Brett Hively from Ameris Bancorp explains:

“This uptick is opening the door for many borrowers to move forward with a home purchase or a refinance program.”

What This Means for You

If you’ve been holding back because you weren’t sure you’d qualify for a mortgage, this could be your chance to take a fresh look at your options. Lending standards may be opening the door a little wider, but they’re still built on a solid foundation.

If you’re ready to explore what’s possible, let’s chat. I can help connect you with a local lender who’ll walk you through your options and help you figure out if now’s the right time for you and your family.