Do You Think the Housing Market’s About To Crash? Read This First

If you’ve been scrolling through social media or catching the news lately, you’ve probably seen some dramatic headlines asking: “Is the housing market about to crash?”

You’re not alone—according to a recent survey by Clever Real Estate, 70% of Americans are worried about a housing crash in 2025. But before you slam the brakes on your plans to buy or sell, let’s take a step back and look at what’s really happening.

The short answer? The housing market isn’t crashing—it’s just adjusting. And that shift could actually work in your favor.

Why the Market Isn’t Headed for a Crash

Let’s talk supply and demand. According to First American’s Chief Economist Mark Fleming:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

When demand outpaces supply—like trying to get tickets to a sold-out show—prices go up. That’s what’s been happening in real estate, and it’s especially true here in the Savannah area. We still have more buyers than homes available, and that keeps home values stable or rising.

Take a look at the national inventory numbers from Realtor.com: while we’re seeing more listings hit the market, we’re still well below what’s considered a balanced level.

That low inventory is one of the main reasons why home prices aren’t dropping. As Lawrence Yun, Chief Economist at the National Association of Realtors, puts it:

“If there’s a shortage, prices simply cannot crash.”

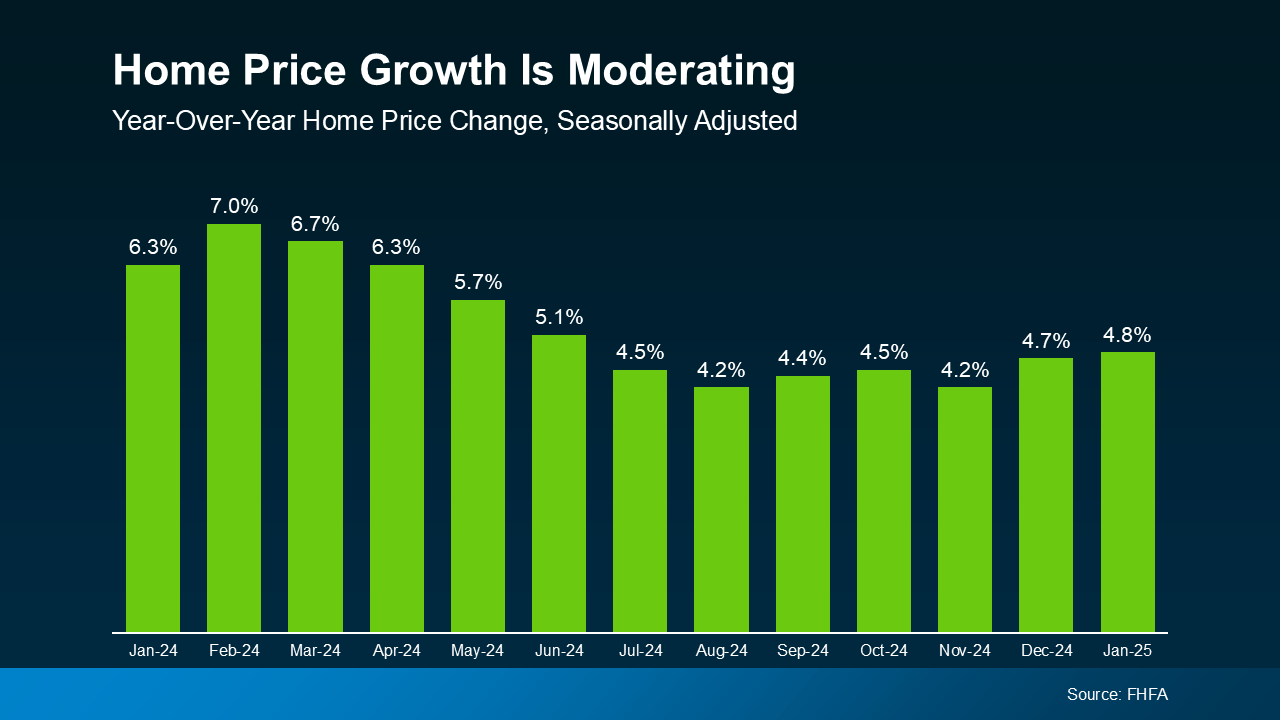

What More Inventory Does Mean: Slower Price Growth

Now, the good news for buyers: as inventory increases, price growth is finally cooling off. That doesn’t mean prices are going down—it just means they’re not rising at the lightning-fast pace we saw in 2020–2022.

According to Freddie Mac:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

In other words, prices are still going up, just more gradually. That creates a healthier, more stable market—one that offers more breathing room for buyers and less volatility for sellers.

What About Here in Savannah?

Here in the Savannah area, we’re seeing some neighborhoods with a bit more inventory (like parts of Pooler and Richmond Hill), but demand is still strong—especially for homes in the $300k–$500k range. The average time on market is still relatively short, and many homes are going under contract quickly if priced correctly.

Whether you’re considering a move soon or just keeping an eye on things, it’s important to understand what’s really going on locally, not just nationally.

Bottom Line

Yes, the market is shifting—but no, it’s not crashing. In fact, most experts agree that a crash in 2025 is highly unlikely unless something drastically changes in the broader economy.

This transition could be a good thing: more inventory, steadier prices, and new opportunities for buyers and sellers alike.

If you’re curious what this means for your next move—whether it’s upgrading, downsizing, or just getting started—I’d love to talk about what’s happening right here in Savannah and how to make the most of it.